Quick Links

- PAN CARD Consultants in Bangalore

- INCOME TAX Consultants in Bangalore

- GST CONSULTANTS IN BANGALORE

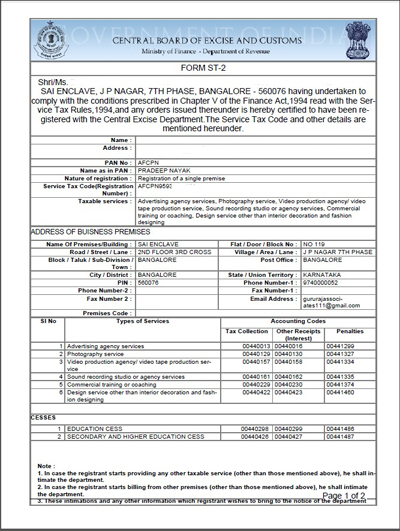

- SERVICE TAX Consultants in Bangalore

- SHOP AND ESTABLISHMENT registration in bangalore

- PARTNERSHIP REGISTRATION IN BANGALORE

- Company Registration Consultants in Bangalore

- IMPORT EXPORT LICENSE Provider in Bangalore

- GST Consultants Bangalore

- Loan Consultants

- Gallery

- Privacy-Policy